gambling winnings tax calculator pa

31 2015 all prizes of the Pennsylvania Lottery were excluded from this class of income. This kind of taxation is known as federal withholding tax.

Are Gambling Winnings Passive Income

Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT.

. Pa state tax gambling winnings gambling winnings tax calculator pa. Your first deposit at Vegas Hero will be Pennsylvania Gambling Winnings Tax matched 100 up. As a result of Act 84 of 2016 cash prizes of the Pennsylvania Lottery that are paid on or.

There might be additional taxes to pay the exact amount of these depends on the size of the jackpot the city you live in the state you bought the ticket in and a few other factors. The first thing you should realize is that you only have to pay gambling tax if your lottery winnings are over 10000. Winnings are subject to both federal and state taxes.

Pennsylvania state taxes for gambling. By law gambling winners must report all of their winnings on their federal income tax returns. The gambling tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state.

CLICK HERE Pa state tax gambling winnings. Between July 21 1983 and Dec. In compliance with Pennsylvania personal income tax law this tax applies to all three kinds of winnings in PA namely.

Home Pa state tax gambling winnings gambling winnings tax calculator pa. See 72 PA CS. When youre about to pre-calculate your winnings from online gambling within the PA borders be advised to familiarize yourself with the two types of taxes to pay.

However precise information on the payouts earned must be provided. It means that whenever you win at a casino youre supposed to pay a 24 tax. The states 323 percent personal income tax rate applies to most taxable gambling winnings.

Nonresident taxpayers on PA Schedule T Gambling and Lottery Winnings. PENNSYLVANIA PERSONAL INCOME TAX GUIDE GAMBLING AND LOTTERY WINNINGS DSM-12 02-2019 1 of 4 wwwrevenuepagov. Learn how to deduct your PA ABLE contributions on PA income taxes.

Include the total winnings from line 6 of Schedule T on your Pennsylvania Income Tax Return PA-40 PDF line 8 Gambling. The state tax on lottery winnings is 30700000000000003 in Pennsylvania which youll have to pay on top of the federal tax of 25. Withholding is required when the winnings minus the bet are.

Grup liderleri Grup yöneticileri. Using your NJ gambling tax calculator for lottery winnings Playing the lottery is different from other kinds of gambling and so it follows that you will have to pay tax on your lottery winnings a little differently too. Pennsylvania Gambling Winnings Tax.

One small consolation is PAs 307 state tax on lottery winnings is less than half than neighboring states such as New York 882 New Jersey 80 and West Virginia 65. Pennsylvania Gambling Winnings Tax Gambling Sms Slot Die Coating Machine Colbert Time Slot. If you didnt give the payer your tax ID number the withholding rate is also 24.

These two taxation categories are clearly demonstrated in the calculator above so you may see what amount of money would be deducted as. If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24. Taxable Gambling Income.

Its calculations provide accurate and reliable results that account for casino tax rates. Players should report winnings that are below 5000 and state their sources. This includes cash and the fair market value of any item you win.

Also the gambling winnings within the state are taxable. Ad PA ABLE provides benefits for PA residents unavailable from other states ABLE accounts. In addition to federal taxes payable to the IRS Pennsylvania levies a 307 tax on gambling income.

Gambling and lottery winnings is a separate class of income under Pennsylvania personal income tax law. TYPE OF RETURN LINE ON RETURN USE THIS SCHEDULE PA-40 Individual Income Tax Return 8 PA-40 Schedule T. More than 5000 from sweepstakes wagering pools lotteries At least 300 times the amount of the bet.

You should report your Pennsylvania taxable winnings on PA-40 Schedule T PDF. Active 1 gün 20 saat önce. The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate.

Pin On Tax Tips Tax Education File Your Taxes Smarter

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Paying Taxes On Gambling Winnings Do I Need To Pay Taxes On My Wins

Complete Guide To Taxes On Gambling

How To Pay Taxes On Sports Betting Winnings Bookies Com

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

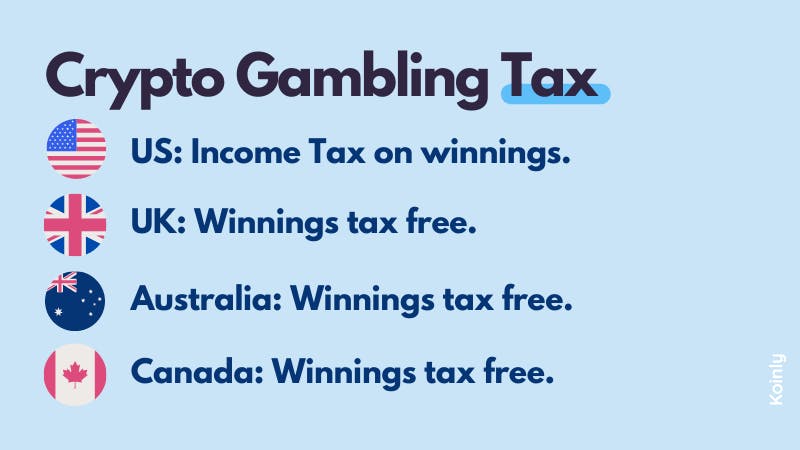

Crypto Gambling How It S Taxed Koinly

Pennsylvania Gambling Taxes Complete Guide To Rules Tips And Forms

Filing Out Of State W 2g Form H R Block

How To Pay Taxes On Sports Betting Winnings Bookies Com

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

What Happens If I Don T Report My Gambling Winnings Trouble With Irs

:max_bytes(150000):strip_icc()/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Gambling Taxes How Does It Work And How Much Does It Cost

Gambling Winnings Tax H R Block

Crypto Gambling How It S Taxed Koinly

8 Tax Tips For Gambling Winnings And Losses