lake county tax bill indiana

Duplicate tax bills for homeowners available at no charge. The order contains the states certification of the approved budget the certified net assessed value the tax rate and the levy for each fund of each taxing unit in a county.

Additional Information On Property Taxes

The Indiana statutes governing the tax sale can be found in IC 6-11-24 and IC 6-11-25.

. Change My Tax Bill Mailing Address Confirm My Jury Duty Summons File For Property Tax Deduction Get a Copy of Birth or Death Certificate Get a Copy of Marriage License Apply for Building Permit Online Reserve Fairgrounds Shelter Request Child Support. Change My Tax Bill Mailing Address Confirm My Jury Duty Summons File For Property Tax Deduction Get a Copy of Birth or Death Certificate Get a Copy of Marriage License Apply for Building Permit Online Reserve. Learn how the County Board has kept the.

You may enter up to 10 valid parcel numbers exactly as they appear on your tax bill including dashes and dot Use the lookup icon next to each parcel number field to perform parcel number search. Please note there is a nomimal convenience fee charged for these services. 847-377-2000 Contact Us Parking and Directions.

Certain types of Tax Records are available to the general. For redemption information or information on assuming title please contact the Lake County Auditors Office at 219 755-3155 link to Auditor. 2022 Lake County Budget Order - Issued January 13 2022.

Fill out the remaining fields and provide electronic signature on the bottom. Ad valorem taxes are levied on real estate property and are based on the assessed value of the. Ad Pay Your Taxes Bill Online with doxo.

Enter PIN or address. Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150. The order also gives the total tax rate for each taxing district.

In the provided example the gross tax liability is 115228. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Lake County collects on average 137 of a propertys assessed fair market value as property tax.

Check out your options for paying your property tax bill. You can access public records by search by street address Parcel ID or various other methods. This exemption provides a deduction in assessed property value.

Ad Find Lake County Online Property Tax Bill Info From 2021. Skip to Main Content. 847-377-2000 Contact Us Parking and Directions.

You may search by owner name parcel number or address. The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes. The deduction amount equals either 60 percent of the assessed value of the home or a maximum of 45000.

As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e-checks. The Department of Local Government Finance DLGF in partnership with the Indiana Business Research Center IBRC at Indiana University created the below tax bill projection tools for Indiana taxpayers. The Lake County Treasurer located in Gary Indiana is responsible for financial transactions including issuing Lake County tax bills collecting personal and real property tax payments.

The Lake County Treasurer and Tax Collectors Office is part of the Lake County Finance Department that encompasses all financial functions of the local. If a figure appears incorrect or inaccurate you. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment.

School districts get the biggest portion about 69 percent. After reviewing the Tax Summary click on Tax Bill in the right hand column. Search Lake County Records Online - Results In Minutes.

ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE BILL FEE PER PARCEL. Lake County tax valuation methods. Office of the Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B Tavares Florida 32778 Phone.

Since the information displayed appears exactly as it is reported from each county some formatting and other errors may be present. Lake County IL 18 N County Street Waukegan IL 60085 Phone. To Print a Tax Bill.

Urges the legislative council to assign to an appropriate interim study committee the task of studying the issue of the impact that tax valuation methods for steel mill equipment oil refinery equipment and petrochemical equipment have on Lake County. Provides that the study should specifically include the. For more information please visit Lake Countys Assessor and Auditor or look up this propertys current valuation.

These records can include Lake County property tax assessments and assessment challenges appraisals and income taxes. Tax Bill Year County Tax Payer Name First Or Last Billing Street Address District Taxing. Lake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lake County Indiana.

Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. This amount must be compared against the cap amount which is shown on Table 2 of the tax bill more on this later. These tools will allow the taxpayer to enter their propertys assessed value and possible deductions to see a range of.

Lake County Assessor Level III Indiana Certified Assessor - Appraiser. Senior citizens as well as all homeowners in Indiana can claim a tax deduction if their home serves as their primary residence. 2021 Lake County Budget Order AMENDED - Issued.

View maps of different taxing districts in Lake Countys Tax District Map Gallery. The tax offices are working in the 2020 year which corresponds to the property tax bill. To print a tax bill please enter your ten-digit PIN.

The median property tax in Lake County Indiana is 1852 per year for a home worth the median value of 135400. Or call the Lake County Treasurers Office at 847-377-2323. In this example the taxes of 68876 are less than the allowable 1296 so no credit is necessary Line.

Select the proper tax year in the drop-down menu and click Tax Bill. Lake County IL 18 N County Street Waukegan IL 60085 Phone. Lake County has one of the highest median property taxes in the United States and is ranked 540th of the 3143 counties in order of median property taxes.

Treasury Department the Treasury Department awarded Lake County Indiana the County 94301324 in Recovery. Download Avalara sales tax rate tables by state or search tax rates by individual address. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs.

Ad valorem is a Latin phrase meaning according to worth. The local and state credits reduce this liability to 68876. Ad Choose Avalara sales tax rate tables by state or look up individual rates by address.

Cool Map Of Birmingham Map Camping Supply Store Birmingham

5 Facts About The Title Insurance Industry Title Insurance Insurance Industry Title

The New Age In Indiana Property Tax Assessment

The New Age In Indiana Property Tax Assessment

Re Max Realty Center Office Recognition

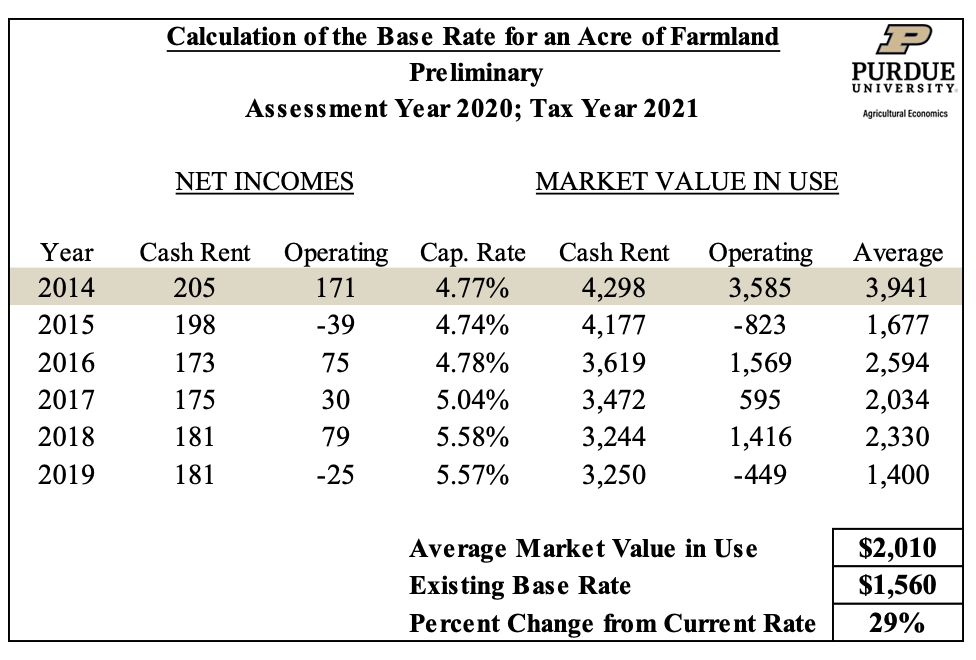

Farmland Assessments Tax Bills Purdue Agricultural Economics

1901 Queen Anne In Brenham Texas Captivating Houses Brenham Mansions Mansions For Sale

Dlgf Citizen S Guide To Property Tax

The New Age In Indiana Property Tax Assessment

The New Age In Indiana Property Tax Assessment

Joe Louis Arena Scoreboard Scoreboard Joe Louis Arena Signage

C 1830 Ripley County Indiana Tax Collector S Tin Box Carried By My Gr Gr Grandfather Alexander Wilson Stewart Who Was The County S Tin Boxes Indiana Ripley