nevada estate tax rate

Compared to the 107 national average that rate is quite low. 31 rows The latest sales tax rates for cities in Nevada NV state.

Nevada Income Taxes Nv State Tax Return No Nv Taxes

There is a federal estate tax that may apply Loading.

. Additionally the City of Las Vegas charges 05 city sales tax the City of Henderson also charges their sales tax percentage. Nevadas tax system ranks 7th overall on our 2022 State Business Tax Climate Index. Whether you are already a resident or just considering moving to Nevada to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

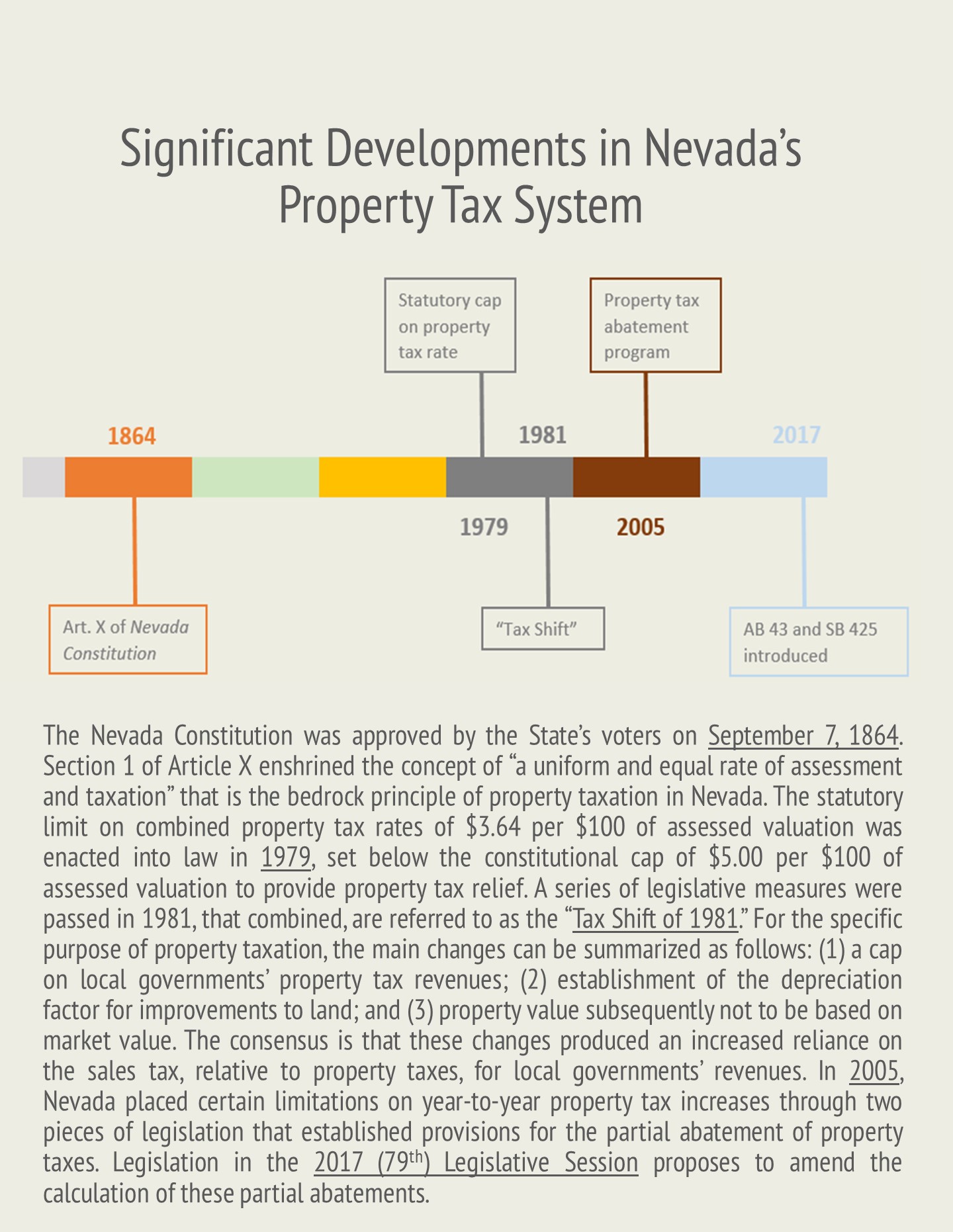

The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation. Whether you are already a resident or just considering moving to Mesquite to live or invest in real estate estimate local property tax rates and learn how real estate tax works. NRS 3614723 provides a partial abatement of taxes.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Taxable Estate Base Taxes Paid. Nevada repealed its estate tax also called a pick-up.

It is one of 38 states in the country that does not levy a tax on estates. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. No estate tax or inheritance tax.

5740 million North Carolina. Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more. Nevada has a 685 percent state sales tax.

Tax Rate 32782 per hundred dollars. Assessors Office 702-455-4997. Nevada property tax rate info by United Paramount Tax Group Compare lowest cheapest and highest NV Personal property taxes.

Search Homes Our Team Our Agents Las Vegas Communities. Prior to the budget hearings the County will publish a newspaper ad which identifies any property tax rate increases as well as. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook.

States With No Property Tax. Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent.

Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. The states average effective property tax rate is just 053. Next find the assessed value which is thirty-five percent of 6428000 or 2249800.

Each states tax code is a multifaceted system with many moving parts and Nevada is no exception. There is no estate tax in Nevada. Rates include state county and city taxes.

Learn all about Nevada real estate tax. Total Taxable value of a new home 200000. Nevada has one of the lowest real estate tax rates in the nation in major part because homeowners are protected from steep property tax increases by Nevadas property tax abatement law that.

Federal Estate Tax Rates for 2022. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323. For more information contact the Department at 775-684-2000.

Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value. Multiply the assessed value by the tax rate which is 32782 in Las Vegas City in 2020-2021. Tax bills requested through the automated system are sent to the mailing address on record.

Under Nevada law there are no inheritance or estate taxes. It is one of the 38 states that does not apply an estate tax. However the property tax rates in Nevada are some of the lowest in the US.

Boulder City NV Sales Tax Rate. Carson City NV Sales Tax Rate. The estate tax is a tax on a persons assets after death.

Nevada is one of seven states that do not collect a personal income tax. Nevada has no state income tax. The top inheritance tax rate is 16 percent no exemption threshold New Mexico.

No estate tax or inheritance tax. Property Tax Rates for Nevada Local Governments Redbook. Finally compare this tax bill with the previous tax bill.

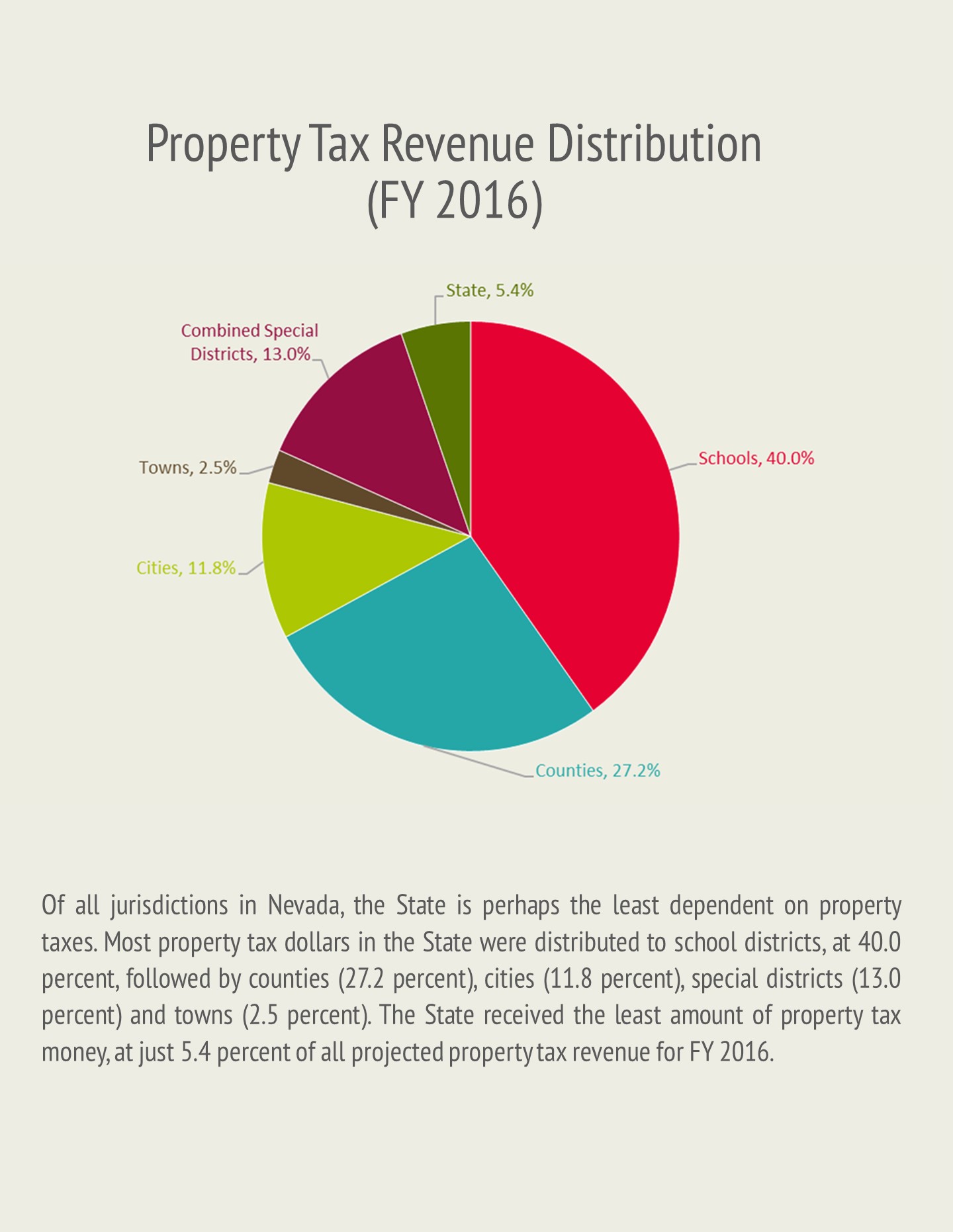

NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. Counties cities school districts special districts such as fire protection districts etc.

The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments. Rate Threshold 1 10000. 2020 rates included for use while preparing your income tax deduction.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates. State Property Tax Rate Median Annual Tax.

Washington estate tax rate 2021 Up to 2193000. Technically the Las Vegas sales tax rate is between 8375 and 875. Nevada Property Taxes Range.

You can look up your recent appraisal by filling out the form below. Please verify your mailing address is correct prior to requesting a bill. Our Rule of Thumb for Las Vegas sales tax is 875.

Learn all about Mesquite real estate tax. Therefore a home which has a replacement value of 100000 will have an assessed value of 35000 100000 x 35 and the home owner will pay approximately 1281 in property taxes 35000 x 3. The median property tax in Nevada is 174900 per year based on a median home value of 20760000 and a median effective property tax rate of 084.

Dayton NV Sales Tax Rate. However revenue lost to Nevada by not having a personal income tax may be made up through other state-level taxes such as the Nevada sales tax and the Nevada. The top estate tax rate is 16 percent exemption threshold.

What state has no property tax. The State of Nevada sales tax rate is 46 added to the Clark County rate of 3775 equals 8375. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005.

Average Property Tax Rate in Nevada. Only the Federal Income Tax applies. FEDERAL ESTATE TAX RATES.

The states average effective property tax rate is just 053. Based on latest data from the US Census Bureau. Assessment Ratio 35.

So even though Nevada does not have an estate tax gift tax or inheritance tax it does not mean that she won. Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected. Nevada repealed its estate tax also called a pick-up tax on Jan.

No estate tax or inheritance tax. As Percentage Of Income. No estate tax or.

Therefore the 2020-2021 taxes for this office building are 7375294. Cold Springs NV Sales Tax Rate. Clark County Managers Office - Budget Division 702-455-3543.

Tax District 200.

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Property Taxes In Nevada Guinn Center For Policy Priorities

Nevada Inheritance Laws What You Should Know

The States With The Highest Capital Gains Tax Rates The Motley Fool

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Taxes In Nevada U S Legal It Group

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Nevada Guinn Center For Policy Priorities

Taxpayer Information Henderson Nv

Property Taxes In Nevada Guinn Center For Policy Priorities

City Of Reno Property Tax City Of Reno